-

Bitcoin Price: $99,548

0.81%

-

All-Time High: $99,537.00

0.02%

- 24h High / 24h Low: $99,537 / $97,394

-

Market Cap: $1,968,489,621,924

1.04%

- 24h Volume: $96,500,815,101

Stablecoins: Financial stability or centralization?

Source: Tether.to

Stablecoins are intended to provide financial stability in the face of price fluctuations in the volatile cryptocurrency market. However, the example of Terra USD shows that even stable coins can be crisis-prone. What if stablecoins are suddenly no longer stable?

What's special about stablecoins

In the volatile cryptocurrency market, traders use stablecoins to hedge their portfolios against fluctuations and declining prices. Once the market rises again, stablecoins can be used to buy other cryptocurrencies like Bitcoin or altcoins without having to resort to traditional FIAT currencies like U.S. dollars, Euros or Yen.

Today, the largest stablecoins have gigantic trading volumes and play a key role in many cryptocurrency trading activities. There are different kinds of stablecoins, such as FIAT-pegged stablecoins, commodity-backed stablecoins (e.g. gold), crypto-backed stablecoins and stablecoins which rely on an algorithmic mechanism to keep them pegged.

Tether, USD Coin, Binance USD

A FIAT-pegged stablecoin is redeemable 1:1 against the respective FIAT currency. The most popular FIAT-pegged stablecoins are dollar-pegged stablecoins like Tether (USDT), USD Coin (USDC) or Binance USD (BUSD). For example, one BUSD always has a value of one U.S. dollar.

Stable or crisis-prone?

The crash of Terra USD shows that there is the possibility for stablecoins to lose their peg. Even though this probability is lower for FIAT-backed stablecoins, there are still some risks that need to be considered before investing in stablecoins. Especially in the case of FIAT-pegged stablecoins, centralization is an issue to be aware of. For example, centralization can be seen in the fact that a single entity often controls a particular stablecoin. Moreover, there are constant rumors about a possible regulation of stablecoins. Being pegged to a FIAT currency like the U.S. dollar also poses a risk to stablecoins. It makes them vulnerable to economic crises and inflation, as the dollar itself is exposed to these.

Disclaimer

This article does not provide investment advice. Historical cryptocurrency data is not a guarantee of future market developments. The author may hold several of the cryptocurrencies mentioned in this article.

Read more About

THIS WEEK’S

Trending Posts

-

September 12, 2024

September 12, 2024The most common misconceptions about Bitcoin and cryptocurrency

-

September 4, 2024

September 4, 2024Stablecoins: Financial stability or centralization?

-

August 11, 2024

August 11, 2024Exploring the benefits and potential uses of Litecoin

-

August 8, 2024

August 8, 2024Five reasons why Bitcoin is superior to FIAT money

-

July 15, 2024

July 15, 2024Dogecoin: the internet's favorite cryptocurrency

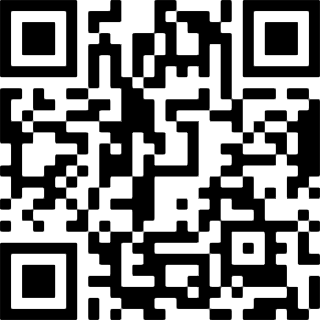

SPREAD THE WORD

Share this Post

HAND-PICKED

Curated Cryptocurrency Posts

Didn't find the answer you were looking for?

Feel free to check our cryptocurrency market data or our comprehensive blockchain glossary.