-

Bitcoin Price: $102,044

2.17%

-

All-Time High: $108,786.00

5.69%

- 24h High / 24h Low: $104,977 / $101,225

-

Market Cap: $2,022,408,963,313

2.13%

- 24h Volume: $66,104,636,570

Explained: Advantages & Disadvantages of KYC

Source: Unsplash.com

When entering the crypto sector, one frequently comes across a so-called KYC procedure. What does KYC mean and why is it required, for example, to start trading on crypto exchanges?

KYC: "Know Your Customer"

Know Your Customer, conveniently referred to as KYC, is a compliance process introduced by regulators for companies to check the identity and risk level of their clients. Especially credit institutions, banks and insurance companies verify the identity of their customers in order to prevent money laundering, economic crime and terrorist financing.

KYC & the crypto space

In the context of cryptocurrencies, the KYC process typically requires an official identity check using a driver’s licence, passport or ID card.

But which cryptocurrency services usually ask for KYC documents? Not only cryptocurrency casinos and sportsbooks will ask you to verify your identity before using the respective platform. Also other service providers and P2P platforms will require a KYC process. And everyone who trades (larger sums of) cryptocurrencies on centralized cryptocurrency exchanges (CEXs e.g. Binance or Kraken) has already gone through a KYC process anyway.

KYC versus decentralization & pseudonymity

As just described, a KYC process is often required before trading cryptocurrencies. But doesn’t that contradict the idea of decentralization if the exchanges collect this personal data centrally? And likewise the idea of pseudonymity of cryptocurrencies? Another disadvantage of KYC is that the process itself is of course very time-consuming. In the case where stolen identity documents were used during the verification process, KYC can help fraudsters to remain undetected.

How "Know Your Customer" can also protect the customer

All in all, the advantages outweigh the disadvantages. On the one hand, KYC procedures are a proven tool to curb illegal activities such as money laundering, scams and fraud. Moreover KYC helps to avoid multi-accounts and thus enables more exclusive offers for the verified users.

Last but not least, KYC regulation not only protects the credit institution or cryptocurrency exchange, but can also protect the customer. Especially in the crypto sector, there are many service providers, exchanges or other platforms that turn out to be a scam after some time. KYC does not guarantee that an institution does not have bad intentions, but it does reduce the probability, as there is always an authority involved that monitors the institution and the KYC procedure.

Disclaimer

This article does not provide investment advice. Historical cryptocurrency data is not a guarantee of future market developments. The author may hold several of the cryptocurrencies mentioned in this article.

Read more About

THIS WEEK’S

Trending Posts

-

September 12, 2024

September 12, 2024The most common misconceptions about Bitcoin and cryptocurrency

-

September 4, 2024

September 4, 2024Stablecoins: Financial stability or centralization?

-

August 11, 2024

August 11, 2024Exploring the benefits and potential uses of Litecoin

-

August 8, 2024

August 8, 2024Five reasons why Bitcoin is superior to FIAT money

-

July 15, 2024

July 15, 2024Dogecoin: the internet's favorite cryptocurrency

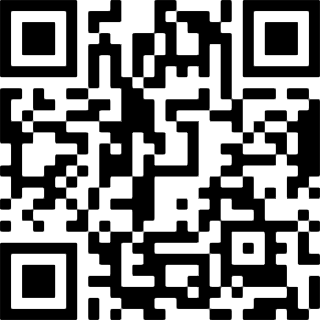

SPREAD THE WORD

Share this Post

HAND-PICKED

Curated Cryptocurrency Posts

Didn't find the answer you were looking for?

Feel free to check our cryptocurrency market data or our comprehensive blockchain glossary.