-

Bitcoin Price: $98,718

6.37%

-

All-Time High: $108,135.00

8.96%

- 24h High / 24h Low: $99,304 / $92,442

-

Market Cap: $1,952,216,728,541

6.04%

- 24h Volume: $53,266,016,002

ECB raises key interest rate again to fight inflation

Source: Unsplash.com

The European Central Bank (ECB) has raised the key interest rate by 75 bps to 1.25%. ECB president Christine Lagarde explained the decision primarily with the rising inflation in the euro zone, which has reached a record high of 9.1%.

ECB raises key interest rate again after historic decision in July

The ECB has raised the key interest rate in the euro zone significantly by 75 bps to 1.25%. It is the biggest increase in the key interest rate ever. This decision can be considered as another step to combat the rising inflation in the euro zone. The ECB had just announced a monetary policy turnaround in July this year by raising the key interest rate from 0.0% to 0.5% for the first time in 11 years.

The announcement of several monetary policy decisions and press conferences by the European Central Bank for today had already caused speculation about a significant increase in the key interest rate.

#ECB today's monetary policy decisions:

— BTCATH (@btcathcom) September 8, 2022

14:15 CET - monetary policy decisions

14:45 CET - press conference with President Lagarde

15:00 CET - monetary policy statement

15:45 CET - staff projections

Fighting inflation at a record high

In an official statement, the ECB decision was explained as follows:

The Governing Council today decided to raise the three key ECB interest rates by 75 basis points. This major step frontloads the transition from the prevailing highly accommodative level of policy rates towards levels that will ensure the timely return of inflation to the ECB’s 2% medium-term target.

We took today’s decision, and expect to raise interest rates further, because inflation remains far too high and is likely to stay above our target for an extended period. According to Eurostat’s flash estimate, inflation reached 9.1 per cent in August.

What does the interest rate increase mean for the crypto market?

What consequences the interest rate increase will have for the Bitcoin price and the crypto market in general is difficult to predict in the long term. In the short term, however, investors should again be prepared for fluctuating prices and volatile markets.

Disclaimer

This article does not provide investment advice. Historical cryptocurrency data is not a guarantee of future market developments. The author may hold several of the cryptocurrencies mentioned in this article.

Read more About

THIS WEEK’S

Trending Posts

-

September 12, 2024

September 12, 2024The most common misconceptions about Bitcoin and cryptocurrency

-

September 4, 2024

September 4, 2024Stablecoins: Financial stability or centralization?

-

August 11, 2024

August 11, 2024Exploring the benefits and potential uses of Litecoin

-

August 8, 2024

August 8, 2024Five reasons why Bitcoin is superior to FIAT money

-

July 15, 2024

July 15, 2024Dogecoin: the internet's favorite cryptocurrency

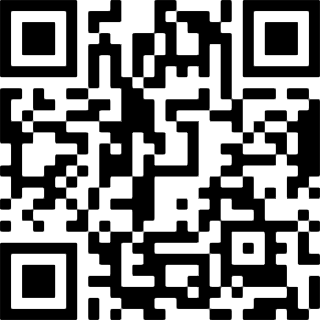

SPREAD THE WORD

Share this Post

HAND-PICKED

Curated Cryptocurrency Posts

Didn't find the answer you were looking for?

Feel free to check our cryptocurrency market data or our comprehensive blockchain glossary.